Learn About Tax Breaks for Freelancers and Self-Employed People

As a freelancer or self-employed, navigating tax policy can be difficult. Knowing what deductions you are entitled to can save you a lot of money. This guide explains the basics of freelance tax deductions and provides practical tax tips for freelancers.

It's Important to Understand Tax Deductions

You are responsible for managing your taxes as a freelancer or self-employed person. This includes understanding freelance tax deductions, which can reduce your taxable income. Many expenses critical to your job can be deducted, resulting in significant savings.

Standard tax deductions for freelancers

Home office deduction

One of the most beneficial tax deductions for freelancers is the home office tax deduction. If you use part of your home exclusively for business purposes, you can deduct part of your mortgage or rent, utility bills, and homeowners insurance.

Key points:

- Must be used regularly and exclusively for business activities.

- Can be based on commercial use area as a percentage of home cost.

Office supplies and equipment

All office supplies and equipment you purchase for your business are deductible, including computers, software, printers, and smaller items like pens and paper.

Key points:

-Keep all receipts and records.

- If necessary, write off more oversized items within a few years.

travel expenses

If you travel for work, you can deduct travel-related expenses such as airfare, hotels, and meals; this is another essential freelance tax deduction that can lower your taxable income.

Key points:

- Must be on a business trip.

- Keep careful records of your expenses.

Internet and phone charges

Internet and phone costs can be passed on if the freelancer uses it for business. This deduction can include home internet service and cell phone plans.

Key points:

- Only business use percentage is deductible.

- Keep careful records of business and personal use.

Education and training

Funding for training and continuing education related to your freelance work is also deductible; this includes courses, workshops, seminars, literature, and online resources.

Key points:

- Must be directly related to your current company.

- Maintain receipts and records of all educational expenses.

Advertising and Marketing

Expenses related to freelance advertising and marketing are fully deductible, including costs for website development, online advertising, business cards and promotional materials.

Key points:

- Consider the cost of online and offline marketing efforts.

- Maintain comprehensive records of all advertising expenditures.

Special deductions for individual industrial and commercial households

Health insurance

If you are self-employed and do not qualify for employer-provided health insurance, you can deduct the health insurance premiums you pay for yourself and your family.

Key points:

- Applies to health, dental and nursing care insurance.

-Must be self-employed and not eligible for employer-sponsored insurance.

Pension contributions

Self-employed individuals can also deduct contributions to retirement accounts such as SEP IRAs, SIMPLE IRAs, and Solo 401(k). These contributions can significantly reduce their taxable income while making retirement planning easier.

Key points:

- Donation limits vary by account type.

- Consult a tax advisor to maximize contributions and deductions.

Professional service

Fees paid to professionals such as accountants, lawyers, or consultants for business-related services are deductible; this may also include the cost of software or online services that make managing the business more accessible.

Key points:

- May be used for commercial purposes only.

- Maintain invoices and records of services provided.

Additional tax tips for freelancers

Keep detailed records

When following liberal tax tips, keeping comprehensive records of all business expenses is essential; this helps you track your deductions and provides necessary documentation in the event of an audit.

Tip:

- Use accounting software to monitor income and expenses.

-Keep all receipts and categorize expenses regularly.

Estimate and pay quarterly taxes

Unlike traditional employees, freelancers and self-employed individuals must pay estimated taxes quarterly; this will help avoid underpayment penalties and large tax bills at the end of the year.

Tip:

- Calculate estimated taxes based on your projected income.

- Use IRS Form 1040-ES to estimate estimated taxes.

Using the Self-Employed Tax Guide

A comprehensive tax guide for self-employed people may be helpful. These guides often provide detailed information about freelancers' and self-employed individuals' deductions, credits, and tax filing requirements.

The main advantage:

- Clearly explain allowable deductions.

- A step-by-step guide to tax preparation and filing.

Tax Planning Strategies for Freelancers

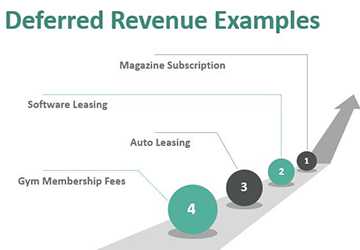

Deferred revenue

If you expect to be in a lower tax bracket next year, consider deferring some of your income until the following year. These tax tips for freelancers can help you reduce your current tax liability.

Key points:

- Ensure compliance with IRS regulations.

- Develop strategies to balance income and deductions effectively.

Pay fees in advance

Prepaying business expenses like rent, utilities, or insurance can maximize your annual deductions.

Key points:

- Pay only necessary and planned expenses in advance.

- Keep careful records of all down payments.

Hire a Family Member

Hiring family members to support your business can provide additional tax benefits. You can deduct wages paid to family members as business expenses and benefit from a lower tax rate.

Key points:

- Ensure that the work performed is legal and necessary.

- Maintain appropriate payroll and documentation.

Freelancers Use Tax Credits

Earned Income Tax Credit (EITC)

Using the Self-Employment Tax Guide, freelancers who fall within certain income limits are eligible for the Earned Income Tax Credit. This credit can significantly reduce your tax liability and even result in a refund.

Key points:

- Eligibility is based on income level and family size.

- Consult a tax advisor to determine eligibility.

Pension contribution credits

This tax credit, or savings credit, is available to freelancers who contribute to retirement savings. It can cover up to 50% of your donation.

Key points:

- Applies to contributions to IRAs, 401(k)s, and other retirement plans.

- Income limits apply to eligibility.

Health insurance tax credit

Using the Self-Employment Tax Guide, the credit can cover a percentage of your insurance premiums.

Key points:

- Qualifying health insurance premiums must be paid.

- Keep careful records of insurance premiums paid.

Conclusion

Understanding and leveraging freelancer tax deductions is essential for maximizing income and mitigating tax liability. By staying informed and keeping detailed records, you can ensure you're taking full advantage of your available deductions. Consult a tax advisor to optimize your tax strategy and comply with IRS regulations.

If you require more detailed information, the Self-Employment Tax Guide can provide valuable insight and ensure you take advantage of all relevant deductions. Implementing these tax tips for freelancers will help you confidently navigate the complexities of self-employment taxes.