Leading Applications for Managing Personal Finances in the Digital Era

Managing your finances is crucial in today's fast-paced, dynamic world. With the advent of digital technology, personal financial management apps have made it easier for individuals to track spending, save money, and plan for the future. These best financial apps offer a variety of features for different financial needs, making them a must-have tool in the digital age.

Features of the Best Financial Apps

When choosing the best financial app, it's essential to consider the features that best suit your needs. Must-have features include:

- Budget Tool: Create and manage budgets easily.

- Expense Tracking: Track all your expenses in one place.

- Investment Tracking: Monitor your investments and their performance.

- Bill Reminders: Never miss a bill payment again.

- Security: Protect your financial data with encryption and other security measures.

Popular apps for personal financial management

Mint

Mint epitomizes unparalleled dominance among personal financial management apps. It offers comprehensive features to make managing your finances more manageable.

- Budget: Create a personalized budget based on your spending habits.

- Expense Tracking: Automatically categorize and track all your expenses.

- Bill Reminders: Get notifications about upcoming bill payments.

- Credit Monitoring: Monitor your credit score for free.

YNAB (You Need a Budget)

YNAB is a powerful budgeting app with a unique methodology that helps users manage their finances. It is one of the most critical financial apps for people who want to run a strict budget.

- The Four Rules Method: Follow the YNAB method to manage your money effectively.

- Goal Setting: Set financial goals and track your progress.

- Live sync: sync your budget across multiple devices.

- Reports: Get detailed reports on your financial activities.

Pocket guard

PocketGuard is another excellent digital financial tool that simplifies budgeting and expense tracking.

- In My Pocket: See how much you can spend after considering bills, goals, and necessities.

- Expense Tracking: Automatically track and categorize your expenses.

- Bill Tracking: Link your bills and get reminders for on-time payments.

- Savings Goals: Easily set and track savings goals.

Personal Capital

Personal Capital offers powerful features that go beyond basic budgeting.

- Investment Tracking: Track your investment account and portfolio performance.

- Net Worth Calculation: Calculate your net worth by linking all your financial accounts.

- Cash Flow Analysis: Analyze your income and spending patterns.

- Retirement Planner: Plan for your retirement with personalized tools and advice.

Good budget

Goodbudget is a personal financial management app based on the envelope budgeting system, perfect for users who prefer the cash budgeting method.

- Envelope Budgeting: Digitally distribute your income into envelopes for different expense categories.

- Expense Tracking: Track your expenses through multiple envelopes.

- Sync and share: Sync your budget with your partner or family.

- Debt Tracking: Manage and track your debt repayments.

Choose the Best Personal Finance Management App

When choosing the financial app that best suits your needs, consider the following factors:

- User Interface: Choose an application with an intuitive and user-friendly interface.

- Customization: Look for apps that offer customization options to fit your financial situation.

- Cost: Some apps are free, others require a subscription. Decide how much you are willing to spend.

- Customer Support: If you face any issues, ensure the app provides adequate customer support.

Advanced Features of Personal Financial Management Apps

Sophisticated Budgeting Techniques

While basic budgeting tools are essential, advanced personal financial management applications provide advanced technology to improve financial control.

- Zero-based budgeting: Allocate every dollar to a specific category and make sure the money is accounted for.

- Forecast Budgeting: Use historical data to predict future spending and revenue trends.

- Multi-account support: Manage budgets from multiple bank accounts and financial institutions.

Comprehensive financial health reporting

Detailed reporting is critical to understanding your financial health.

- Spend Analysis: Break down spending by category and period.

- Income vs. Expenses: Visualize the balance between income and expenses over time.

- Financial Ratios: Calculate vital financial metrics such as savings rate and debt-to-income ratio.

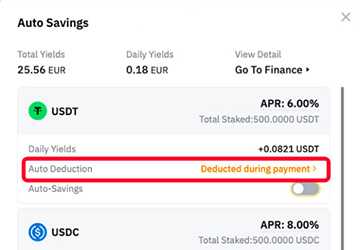

Integrate Investing and Savings Goals

Digital financial instruments often combine investment and savings goals to promote long-term economic well-being.

- Automatic Savings Plan: Set regular transfers to savings accounts based on predefined goals.

- Investment Forecast: Use the built-in calculator to predict future investment growth.

- Goal Tracking: Monitor progress towards financial goals, such as B. Buying a home or retiring.

Security and privacy features

Personal financial management apps take user privacy and data protection seriously.

- Two-factor authentication: Increase account security with an extra verification step.

- Data encryption: Ensure all financial data is encrypted in transit and at rest.

- Privacy controls: Users can manage permissions and control their data usage.

Cutting-edge technology in financial applications

Artificial Intelligence and Machine Learning

Modern personal financial management apps use artificial intelligence and machine learning to improve functionality.

- Predictive analytics: Use artificial intelligence to predict spending patterns and potential financial challenges.

- Personal Advice: Get financial advice tailored to your habits and goals.

- Automatic expense classification: Machine learning calculates expenses accurately without manual entry.

Blockchain and cryptocurrency integration

As digital currencies become more popular, some digital financial instruments combine blockchain technology with cryptocurrency management.

- Crypto Wallet: Manage and track various cryptocurrencies alongside traditional finance.

- Blockchain Security: Benefit from blockchain technology's additional security and transparency.

- Investment Opportunities: Discover potential investments in the cryptocurrency market directly within the application.

Voice-controlled financial management

Among some digital financial tools, voice recognition technology is making its way into personal financial management applications, enabling hands-free management.

- Voice commands: Check your balance, track expenses, and set reminders using voice commands.

- Smart Assistant: Integrate intelligent assistants such as Alexa or Google Assistant for seamless financial management.

- Live Updates: Get real-time financial updates and alerts with voice notifications.

Biometric security features

In some digital financial tools, biometric security features can protect personal financial management applications.

- Fingerprint recognition: Securely log in to your financial apps using a fingerprint scan.

- Facial Recognition: Improve security and convenience with facial recognition technology.

- Behavioral Biometrics: Monitor unique user behaviour to detect and prevent unauthorized access.

Conclusion

Managing your finances doesn't have to be complicated. With the right personal financial management app, you can easily take control of your financial future. These best finance apps offer a range of features to help you budget, track spending, and save money, making them essential tools in the digital age. By using these digital financial tools, you can achieve your financial goals and secure a better future.